Need Cash Now?

Get Personal Loan Singapore,

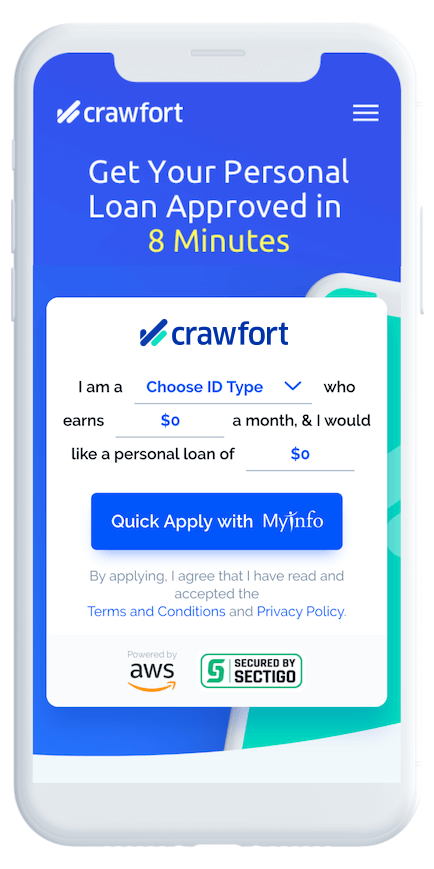

8-Minute Approval.

Need Cash Now?

Get Personal Loan Singapore,

8-Minute Approval.

A Personal Loan to Reach Your Financial Goals!

A Personal Loan to Reach Your Financial Goals!

Need some extra cash to make your dreams happen this year? Or maybe got urgent money problems? A fast personal loan in Singapore can really help you out.

At Crawfort Singapore, your personal loan can get approved in just 8 minutes!

Personal Loan is Super Easy and Fast! 3 Steps Only

Personal Loan is Super Easy and Fast! 3 Steps Only

Apply With MyInfo

No need to fill up long forms! Just use your SingPass and MyInfo, your application is all filled up already.

Check Your Results

8 minutes only, then we’ll SMS you whether your loan is approved!

Collect Your Loan

Go down at our office, sign the papers, and the cash is yours!

No More Money Worries!

No More Money Worries!

We know financial stress can be tough. That’s why our loan plans are designed to give you the support you need, so you can breathe easy and focus on what matters. Here’s what you can count on: all filled up already.

Why a Personal Loan Can Help?

Why a Personal Loan Can Help?

Ever feel like you’re barely keeping your head above water? Bills piling up, unexpected costs, and your paycheck just doesn’t stretch far enough. Sound familiar? That’s where a personal loan can be a lifesaver.

Here are some common situations:

Need Cash? Here’s a Quick Guide on Personal Loans in Singapore

Need Cash? Here’s a Quick Guide on Personal Loans in Singapore

Sometimes life throws you a curveball, and you need some extra cash, right? Whether it’s to make your dreams come true or just to stay afloat, a personal loan can help. But if this is your first time borrowing from a licensed money lender, the whole thing can feel a bit confusing.

So, here’s what you MUST KNOW before taking out a personal loan:

Ready for a Personal Loan? Get Informed and Choose Wisely

Ready for a Personal Loan? Get Informed and Choose Wisely

Understand your options and find the loan that fits your goals