Ultimate Guide To Finding the Best Licensed Moneylenders In Singapore

Ultimate Guide To Finding the Best Licensed Moneylenders In Singapore

Are you short on funds and considering a loan from a licensed money lender in Singapore? Before you do, it’s essential to understand these key factors:

Living in one of the world’s most expensive cities, like Singapore, can make it difficult to cover unexpected bills and expenses without help. Large costs, such as medical bills or wedding arrangements, can quickly become overwhelming.

When you need money quickly, traditional bank loans might not be the best option due to their lengthy and strict approval processes. Licensed moneylenders offer a viable alternative with faster approval times. However, borrowing from them, even with 24-hour licensed money lenders in Singapore, might still raise concerns for some.

One common question is, “Is borrowing from a licensed moneylender really safe?” It’s crucial to realize that the Ministry of Law (MinLaw) in Singapore strictly regulates all licensed moneylenders, unlike illegal moneylenders. This makes borrowing from them a safe option.

Before you secure a loan from the best licensed moneylender in Singapore, consider these important things:

- Your financial needs: Determine the exact amount you need and why.

- Repayment ability: Ensure you can comfortably afford the monthly payments.

- Interest rates: Compare rates offered by different licensed moneylenders.

- Terms and conditions: Carefully read and understand the contract before signing.

- Reputation: Choose a licensed moneylender with a positive track record.

Smart Borrowing: What to Do Before Taking a Licensed Moneylender Loan

Choosing the Right Loan from a Licensed Moneylender

Before applying for a personal loan in Singapore, it’s essential to take these steps:

- Assess Your Needs: Determine the right type of loan based on the scale of your financial situation. Personal loans are excellent for smaller emergencies, home renovations, paying off credit card debt, or consolidating existing debts.

- Research Thoroughly: Once you know the loan type, research the repayment terms offered by different licensed moneylenders.

- Review Your Credit Report: Purchase your credit report from the Credit Bureau Singapore (CBS) or the Moneylenders Credit Bureau (MLCB). While many moneylenders may not rely heavily on credit scores, some may refuse loans to those with poor credit. If your score is low, work on improving it before applying.

- Verify Your Eligibility: Ensure you meet the eligibility requirements for your chosen loan type. In Singapore, the maximum loan amount is tied to your annual income.

| Annual income | Singapore Citizens and Permanent Residents | Foreigners residing in Singapore |

|---|---|---|

| Less than S$10,000 | S$3,000 | S$500 |

| At least S$10,000 and less than S$20,000 | S$3,000 | S$3,000 |

| At least S$20,000 | 6 times of monthly income | 6 times of monthly income |

Get Ready: Documents Needed for a Licensed Moneylender

Applying for a loan from a licensed moneylender? Don’t show up unprepared! Make sure you have these documents ready:

- Proof of income and employment: Think paystubs or tax returns.

- Your NRIC

- Proof of residency: A utility bill or lease agreement should work.

- Foreigners, take note: You’ll need your tenancy agreement, employment letter or pass, and bank statements.

Important to know: Licensed moneylenders care more about your income than your credit score when approving personal loans. That’s why they need documents proving you can afford the payments.

Are there limits on how much a licensed moneylender can charge me?

Singapore licensed moneylenders are strictly regulated by MinLaw. They have limits on interest rates, late fees, and administrative costs. These limits protect borrowers from excessive charges.

Licensed moneylenders in Singapore cannot charge you:

- More than 4% interest per month

- More than 4% late interest per month

- Late fees exceeding S$60 per month

- Administrative fees higher than 10% of your loan amount

- Legal costs unless ordered by a court

Total costs (interest, fees, etc.) cannot be more than the original loan amount.

Unmasking Loan Scams: How to Spot a Licensed Moneylender

Getting a loan can be a solution in a time of need, but it’s incredibly important to protect yourself from scams. Here’s the lowdown on how to separate the legitimate lenders from those out to take advantage of you:

Ministry of Law: Your Safety Net

- The Master List: Your first move should always be to check the Ministry of Law’s (MinLaw) official, ever-evolving list of licensed moneylenders in Singapore. You can find it online on their website. If the lender isn’t there, walk away.

- Borrower Beware: Don’t just check the list; scan those lender reviews too! Past experiences can offer valuable insights.

Red Flags in Advertising

- Uninvited Advances: Got a loan offer via a random phone call, text message, or social media? That’s a major red flag. Licensed lenders can’t solicit business this way.

- Stick to the Rules: Licensed lenders can only advertise on business directories, their own websites, and within their physical place of business.

Know Your Numbers: Rates and Fees

- Know the Limits: Licensed lenders must follow strict interest rate and fee regulations set by MinLaw. Interest rates can’t top 4% a month, and late payment fees have defined limits too. Anything higher is a big no-no.

- Clarity is Key: A reputable lender will clearly explain all interest rates and fees upfront before you sign anything.

Physical Presence Matters

- Location, Location, Location: If a lender doesn’t have a physical business address listed on MinLaw, steer clear. Legitimate lenders need a location for face-to-face verification.

- No Meet-Ups in the Shadows: Dodgy deals in strange locations scream “scam”. Licensed lenders conduct business at their established offices.

Verification and Paperwork

- Face Time: While some initial steps may happen online, licensed lenders are required by law to do an in-person verification before disbursing any funds. No in-person verification? No loan.

- Contractual Obligations: Before you sign anything, the lender must explain the loan contract thoroughly. It should include all the nitty-gritty details like interest rates, terms, and repayment schedule.

Extra Vigilance Tips

- Don’t Hand Over ID: Licensed lenders should never retain your NRIC or other identification documents. They need to verify, not keep.

- Avoid Pre-Approval Pressure: If a lender tries to rush you into a loan before you’ve had time to understand everything, it’s a sign something is wrong.

Protecting Yourself When Working with Licensed Moneylenders

Licensed moneylenders in Singapore offer a legitimate way to obtain funds, but it’s crucial to stay vigilant. Here’s what to watch for:

Red Flags to Report:

- Abusive or threatening behavior by the lender.

- Requests for your Singpass ID or password.

- Withholding your essential identification documents.

- Pressure to sign incomplete or blank contracts.

- Failure to provide a copy of the loan contract.

- Inadequate explanation of loan terms.

- Loan approval without due process (e.g., solely over the phone).

- Unexplained deductions from the loan amount.

- If you encounter any of these, report the lender to the Registry of Moneylenders (1800-2255-529) with their business details. You can also consider action through the Small Claims Tribunal or under the Consumer Protection (Fair Trading) Act.

Once Your Loan is Approved

- Verify the Fees: Legitimate lenders can charge up to 10% of the principal as an administrative fee. Double-check for overcharges.

- Keep Your Records: Hold onto the loan contract, payment receipts, a statement of account for all loans, and any other relevant paperwork.

- Pay On Time: Defaulting incurs late fees and interest (up to 4% monthly). Prompt payments keep your debt manageable.

Struggling with Repayment? Here’s What To Do

- Communicate and Negotiate: Talk to your lender about a potential extension.

- Seek Help: Credit counseling and debt management services can assist with budgeting and repayment plans.

- Bankruptcy (Last Resort): If your debt is at least S$15,000 and unmanageable even with restructuring, bankruptcy freezes interest and legal actions against you.

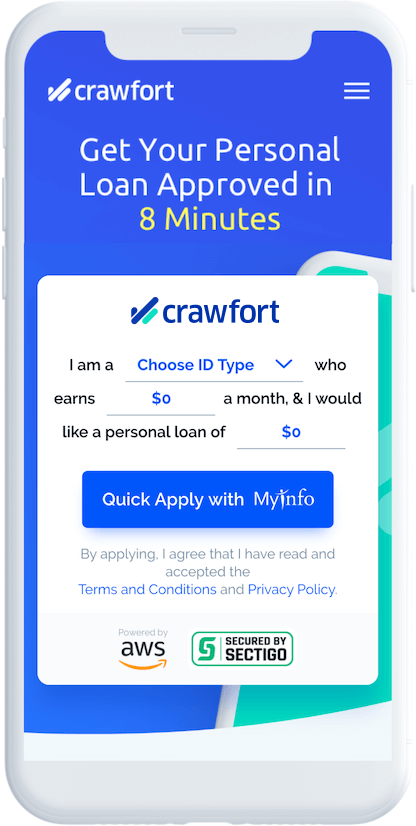

Borrowing responsibly is vital. Only choose a licensed lender like Crawfort when necessary and fully understand your repayment obligations.

When Debt Becomes Overwhelming: Organizations Offering Support

If you’re struggling with significant debt, filing for bankruptcy should be considered only as a last resort. Here are organizations in Singapore that can provide guidance and support in managing your situation:

- Credit Counselling Singapore (CCS): A non-profit organization focused on financial health, CCS offers counseling and educational resources to help you create a manageable debt repayment plan.

- Registry of Moneylenders (MinLaw): This government body regulates moneylenders in Singapore. Before taking a loan, always verify a lender’s licensed status on the Registry’s list. Their FAQ section also provides essential information for borrowers.

- Credit Collection Association of Singapore (CCAS): CCAS represents credit agencies and enforces a code of conduct. If you have a dispute with a lender, CCAS offers resolution services.

- National Council on Problem Gambling (NCPG): If gambling addiction has fueled your debt, NCPG provides support and resources to help individuals and families overcome this issue.

- Credit Association of Singapore: This association represents licensed moneylenders. Contact them for information on borrowing responsibly and to find reputable lenders.

- ComCare (MSF): As part of the Ministry of Social and Family Development, ComCare offers various forms of assistance, including urgent financial aid, to empower low-income individuals and families.

Important Considerations

While short-term loans can offer temporary relief in a financial crisis, prioritize borrowing from reputable institutions like banks. If you need to consider a private moneylender, always ensure they are licensed to avoid high-interest rates or scams. Report any illegal money-lending activity to the police.

Need urgent cash? If you’ve considered the alternatives and a licensed moneylender is your best option, Crawfort is an established and reputable lender in Singapore. Apply for a loan today!